Studies indicate that the effect can persist for as long as a year after the announcement. The stock prices of firms with significant positive earnings surprises show above-average performance, while those with negative surprises have below-average performance.Ĭhanges in stock price resulting from an earnings surprise can be felt immediately, and the surprise has a long-term effect. Negative earnings surprises occur when reported earnings per share are significantly below the earnings expectations. Positive earnings surprises occur when actual reported earnings are significantly above the forecasted earnings per share. Firms with significant earnings surprises are often highlighted. During the earnings reporting season, business news channels and financial websites provide daily reports on earnings announcements. Most companies announce earnings approximately one month after the end of the quarter. Earnings surprises occur when a company reports actual earnings that differ from consensus earnings estimates. It is common to see price declines for stocks that report earnings increases from the previous reporting period because, in many cases, while the actual earnings represent an increase, the increase is not as great as the market had expected. In using earnings estimates, the first rule to keep in mind is that the current price usually reflects the consensus earnings estimate. Tracking these expectations and their changes is an important and rewarding strategy for stock investors. Services such as Refinitiv I/B/E/S and Zacks Investment Research provide consensus earnings estimates by tracking the estimates of thousands of investment analysts. There are several services that track and analyze expected earnings estimates. Security prices are established through expectations, and prices change as these expectations change or are proven incorrect. Investors quickly learn that the market is forward-looking. There are 13 Dow Jones industrial average components and over 100 S&P 500 companies scheduled to report earnings.Įxpectations play a key role in determining if a stock’s price “gains” or “loses” when actual earnings are reported. This week, Wall Street prepares for the busiest week of earnings announcements.

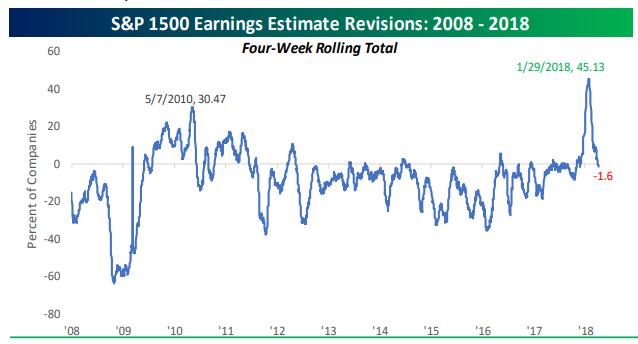

Goldman Sachs forecasts gross domestic product (GDP) growth of 6.6% on a full-year basis for 2021. Hit hard at the start of the coronavirus pandemic, analyst estimates for several apparel and accessories retailers that currently pass the Estimate Revisions Top 30 Up screen are expected to improve, driven by mass vaccinations, bigger stimulus checks to support consumer spending and a resurgent economy. The Estimate Revisions Down 5% screen normally averages around 65 holdings that pass the monthly screen-in April 2020, during the early days of the pandemic, it reached 628 passing the screen-nine months later, there are only 14 companies passing the screen. There are two interesting observations from the earnings estimate revisions screens. Other industries that have seen substantial declines in consensus earnings estimates are casinos and gaming and freight and logistics. Significant cuts have been made to estimates for companies in struggling industries like commercial real estate and restaurants and bars.

0 kommentar(er)

0 kommentar(er)